The ABSA Gold credit card is an exceptional card that is offering high value for your money It provides all payback advantages of other 1st tier credit cards and charges a minimal account fee each month. It lets you have endless credit card value anytime and anywhere. It offers endless value to allow its users to enjoy their life, along with benefits and low costs.

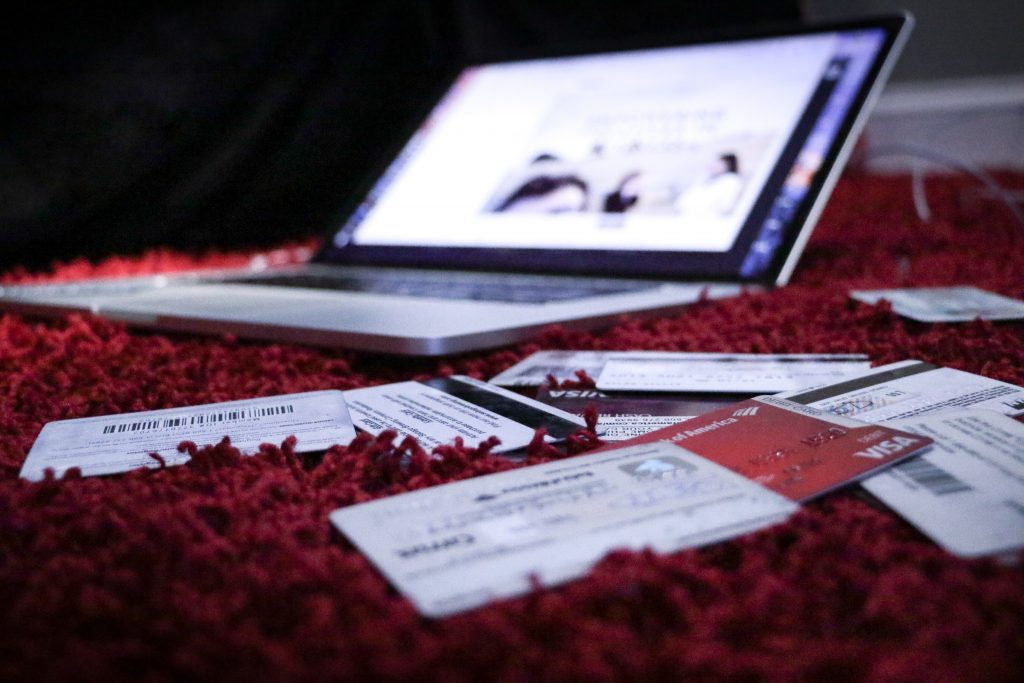

With it, you can pay both in-store and online conveniently. It competes in the market with its maximum credit value for its users that is available for purchases wherever the credit card user prefers to redeem it. The credit limit is also from time to time reviewed to ensure cardholders have the credit they want or desire at that time. Read this article to know more details!

For digital banking, the cardholders have access to the Absa banking app, which lets you change your credit card or stop it. Use the app to report fraud and regulate your everyday card limits 24/7 from anywhere. It also provides free lost credit card protection. If you lose your credit card then you must inform the bank in the given reporting time. For more user security, you can stimulate SMS notifications that alert you of every activity on your account.

When traveling, you can access exceptional charges at Bidvest Airport Lounge. Absa credit card also provides basic insurance for traveling. While spending for each purchase, you get cashback whether the purchase is made locally or internationally. Absa banking app also offers payments when you complete simple tests on their app. You also have the option to make contactless using the card where it is accepted.

If you have an Absa gold credit card, you can get special rates at Bidvest Airport lounges. Being an Absa credit cardholder, you have the option to use it both in the locality and all over the world. But you will be paying a 2.75% fee for international transactions. This ABSA credit card fee is lower and affordable when compared with other rival credit cards.

This credit card also gives the best lifestyle benefits. With their Notify app, you can receive notifications for each transaction performed with a card. With it, the card also gives life protection for a free lifestyle. It means that your credit will not affect your family if the card owner becomes ill, suffers a disability, or dies. With it, you will also get completely free access to Absa digital platform.

This credit card gives a max. credit of R 90,000, which is related directly to your affordability. You have to pay a monthly fee of R 23 for an account. If your balance appears outstanding, you have to pay a 3% minimum on that outstanding due balance. This card also provides a 57 days’ free interest credit period. Using this card also provides simple travel insurance of R 1,500,000 for global traveling.

This gold card is your smart way to shop and pay securely online and physically. You can scan, tap, or swipe to make a payment with your credit card, the device you wear daily, or smartphone at any worldwide point of sale machine. The card pays you back rewards for every purchase you make with it. With it, the Absa card gives a high credit limit of about R90,000 to its users.

To get this credit card, you must be earning a minimum of R 4000 to R 25 000 per month. You have to be at least 18 years old when you are applying. With it, you must have the right smart card or South African ID with residence proof that is not more than three months older. You will also need the most recent income proof showing the past three months’ income.

You have flexible options to order your card. The existing Absa online banking customers can log in to their portal and apply for the credit card easily. For the new Absa credit card customers, you have the option to either apply online for their credit card by following their 5 step credit application. Or you can place a card with the telephonic application by calling them on 0861 114 411.

To apply for the credit card online, you have to apply on their website following the 5-step credit card application process. You have to visit their website and click on the Apply now button. In the application stage, enter all characters as they are displayed in the image; as it is done, complete the six-step assessment. During the six-step assessment, you can save and continue each step later or complete the application in one attempt. As it finishes, click on the Apply button, and you have applied for their credit card.

This credit card is a good option among all similar cards. It offers a high credit limit with low and personalized interest rates. But it loses competitive advantage on other benefits like the free private lounge in airport visits and free entry in their rewards program. But at the same time, it gives endless value for your money, charges a low fee per month, and has new tech features for in-store and online transactions. Lifestyle benefits like cashback rewards and discounts on particular buying with travel benefits are complementary.

Originally posted 2022-08-08 10:00:02.